|

Apptricity Expense Help |

Per Diem is the amount an organization pays for an employee’s daily expenditures. Per diem expenses include: meals, lodging, car rental, incidentals, taxis and public transportation, and entertainment.

Apptricity Expense Administrators are responsible for ensuring new and existing per diem rates are current and up-to-date with the US General Service Administration’s (GSA) scheduled rates and organization-defined travel policies.

GSA per diem rates are the national standard by which most companies calculate per diem rates. Per diem rates are updated yearly and are geographically specific.

For example, according to FY 2017 figures, the GSA per diem M&IE rate for Los Angeles is $64, while in Lubbock, Texas the rate is $51.

International per diem rates are set by the US Department of State and vary from country to country. You get more in Belgium than Belarus, for example.

Expense also allows organizations to enter in their own per diem rates. That is the power of customization that Apptricity applications offer. Most organizations, however, adhere to the standard GSA rates. This is the default setting here in Expense.

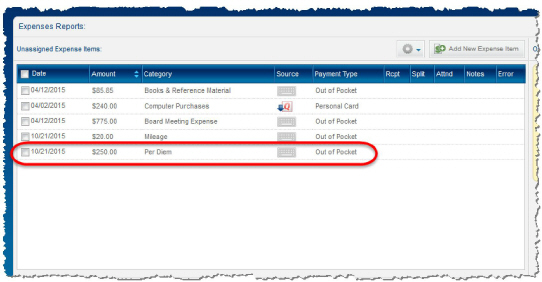

Expense reports created in Expense display Per Diem items as a line item on the report, as show in the image below: